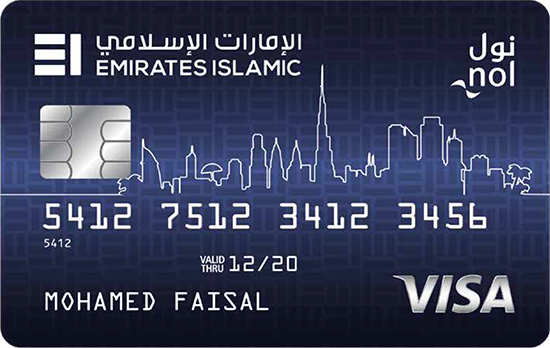

Emirates Islamic RTA Card

Minimum Salary: AED 5,000

Annual Fee: Free for Life | Rate: 3.49%

✨Features:

Cash Back, Discounts / Vouchers / Offers, Balance Transfer, Islamic Finance, No Salary Transfer

RTA Credit Card Features

Your minimum income should be AED 5,000 per month

Age 21 or older

Credit Card Highlights

- Log in to your Emirates Islamic account through Online Banking or Mobile Banking

- Click on ‘Cards’

- Tap on ‘Rewards’

- Select ‘Redemption’ and submit your request.

- Redeem your cashback points within seconds through Online Banking or through our Mobile Banking app.

- Earn up to 2.25% cashback per AED 1 Spend.

- Get 10% Cashback on RTA Transport Payment.

Benefits

- Facilities available on the RTA Credit Card

- Complimentary Reel Cinemas Movie Tickets

- Enjoy 15% off on Emaar Entertainment Attractions

- Emergency Cash and Card replacement

- Extended Warranty

- Payment Options

- Purchase Protection

- 5,000 AED For UAE Nationals

- 10,000 AED For Expats

Top 3 Emirates Islamic Credit Card Benefits

Easy Installment Plan

Cash Loan

Citi Promotions

Calculator Definitions

Additional Information

By clicking Submit, I acknowledge that my details will be shared with Gulf Policy Souq and passed to Emirates Islamic Bank PJSC. I consent to the use of my information to assess, process, and offer Shariah-compliant banking products and services and to share my details with any UAE credit bureau and make related enquiries in accordance with applicable laws.

I authorize Emirates Islamic representatives to contact me using my provided contact details regarding Emirates Islamic products or services within 12 months from this acknowledgment. I confirm that the information provided is true and accurate and acknowledge that submission does not obligate Emirates Islamic to approve or provide any financing or banking facility.

RELATED CREDIT CARDS

The American Express Dubai Duty Free Card

Minimum Salary: AED 15,000

Annual Fee: AED 175 | Rate: 3.25%

✨Features:

Discounts / Vouchers / Offers, No Salary Transfer

DIB Al Islami Classic Charge Card

Minimum Salary: AED 5,000

Annual Fee: AED 195 | Rate: 3.25%

✨Features:

Roadside Assistance, No Salary Transfer

ADIB Etisalat Visa Signature Card

Minimum Salary: AED 15,000

Annual Fee: AED 1,199 | Rate: 3.09%

✨Features:

Discounts / Vouchers / Offers, Sharia Compliant, No Salary Transfer

Our Network of Industry-Leading Partners

Our Advisors Are Ready To Help You

Our experts are available to guide you toward the best insurance choices.